Budgeting 101: Get Started on Budgeting

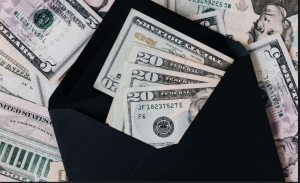

Budgeting allows you to pay attention to your expenses and spend only what you earn. It gives you control over your finances and helps you save money and make sound financial choices. Most importantly, it makes managing your money much easier. On top of that, budgets also allow you to track your spending and figure out where your money goes every month. You don’t have to be a finance expert or get into accounting to start and manage a budget. Here are some simple steps you can take today to start creating and using a budget.

bugeting tips

Step 1: Decide if You Need a Budget (You Obviously Do!)

If you’re like most people, you probably already know that you need a budget. But do you really understand why? If not, here’s the basic reason: A budget is an effective tool for controlling your money. Without one, you’ll likely find yourself in debt and struggling financially. That’s because, without a plan, you won’t be able to keep up with all of your bills and expenses.

Step 2: Set Up Your Budget

The first step in budgeting is deciding which type of budget will work best for you. There are two main types of budgets: Spending Budgets and Income Budgets. Both are equally important, but they serve different purposes.

Step 3: Track Your Expenses

Once you’ve decided on the type of budget you want to use, you should begin tracking your monthly expenses. This includes everything from rent/mortgage payments to car insurance premiums. Be sure to include any recurring monthly bills such as utilities, credit card fees, student loan payments and other fixed costs.

Step 4: Calculate Your Monthly Net Worth

Once you have tracked your expenses, you can calculate your net worth. Simply subtract your total debts from your total assets. The result is your net worth.

Step 5: Figure Out How Much Money You Have Available Each Month

Now that you have calculated your net worth, you can determine how much money you have available each month. To do this, divide your net worth by 12 and multiply that number by 100.

Avoid Unnecessary Spending

It may seem obvious, but when you’re starting a new budget, avoid unnecessary spending. Don’t go shopping just because you feel like it, and don’t go gambling online just because you think it will get you richer. Instead, stick to your list of items you actually need. And if you see something you want, wait until later to buy it.

Conclusion

Creating a budget doesn’t have to be difficult. In fact, once you get started, you’ll realize that it’s pretty easy to stay on track. Once you get going, you’ll soon find that you’re more organized and better at saving money. So get started today!