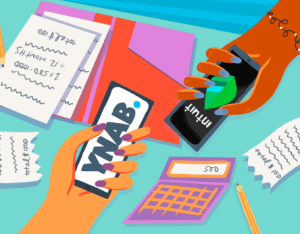

Essential Budget and Finance Apps Every Smartphone User Needs

Your monthly mobile bill can easily add up, especially during tax season. Many new smartphones come preloaded with dozens of free applications, but some of those apps aren’t worth keeping. In addition, the average smartphone customer has 30 or 40 other applications installed, and many of them are duplicates of the same core apps. This means they don’t really provide much-added value and actually slow down performance. Fortunately, there are several essential budget apps that you simply cannot live without.

Get Yourself a Financial Assistant

When it comes to real money, your bank is always going to be in control. But when it comes to managing your personal finances, your phone should also have access to this information. A good financial assistant app will:

- Help you track all your transactions across multiple accounts.

- Provide alerts for spending limits, budget deadlines, and anything else important.

- Keep records of your income and expenses so you can see where your money goes.

- Track your investments and keep tabs on their progress.

Mint

One of the top five financial tools according to Forbes, Mint connects directly to your bank account and lets you view your spending habits through graphs, charts, and notifications. Plus, you can also compare your income against your expenses and adjust your savings goals accordingly.

Personal Capital

If you’re looking to invest more wisely, personal capital makes it easy to track stocks, bonds, IRAs, 401(k), dividends, and even real estate. You can monitor your portfolio from anywhere, using either desktop or mobile devices.

TurboTax Mobile

For self-employed individuals, TurboTax Mobile allows you to file taxes anytime, anywhere. The app can connect to your W2 information automatically using eFiling and then sync your return data back to your computer.

Bankrate Mobile

This handy app provides you with access to your checking and savings accounts 24/7, as well as alerts when you need to make a payment on time. Plus, Bankrate Mobile will even remind you if your balance is below your minimum or overage, so you never have to worry about overdraft fees.

Conclusion

These are just a few examples of the hundreds of great real money financial apps available for smartphones today. Whether you’re an expert investor, a novice saver, or somewhere in between, these apps can help you manage your money better while giving you peace of mind.